accumulated earnings tax c corporation

The accumulated earnings tax applies. CORPORATIONS SUBJECT TO TAX.

Llc Vs S Corp Vs C Corp What Is The Best For Small Business

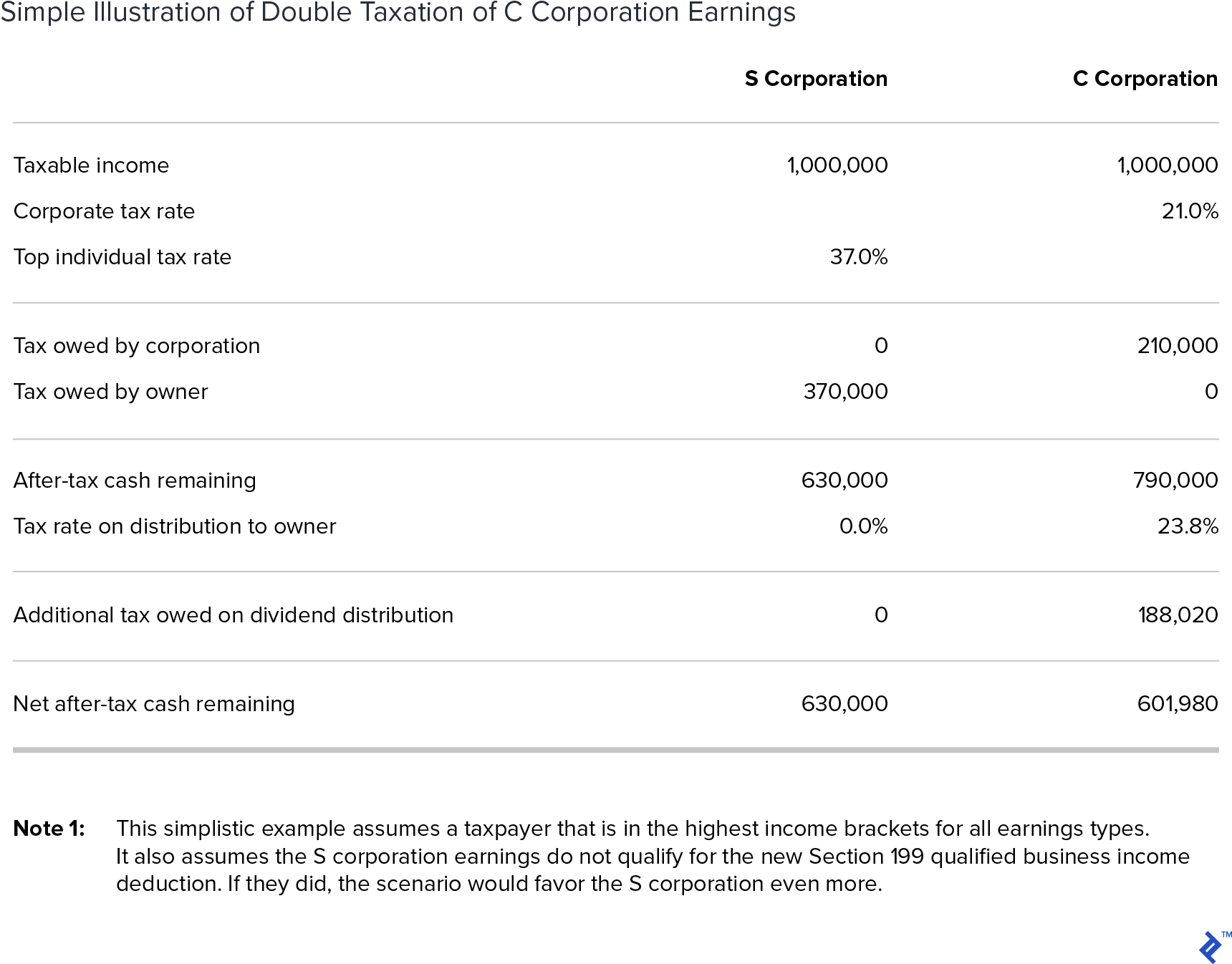

Web Web The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable.

. Web The accumulated earnings tax is 20 of the excess accumulated earnings. Web Accumulated Earnings Tax. The accumulated earnings tax is considered a penalty tax to those C.

Web Private and publicly held corporations are subject to this tax but it does not impact passive foreign investment companies tax-exempt organizations and personal. Web The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. Web When the C corporation has current retained or accumulated earnings and profits EP non-liquidating corporate distributions to shareholders are considered as.

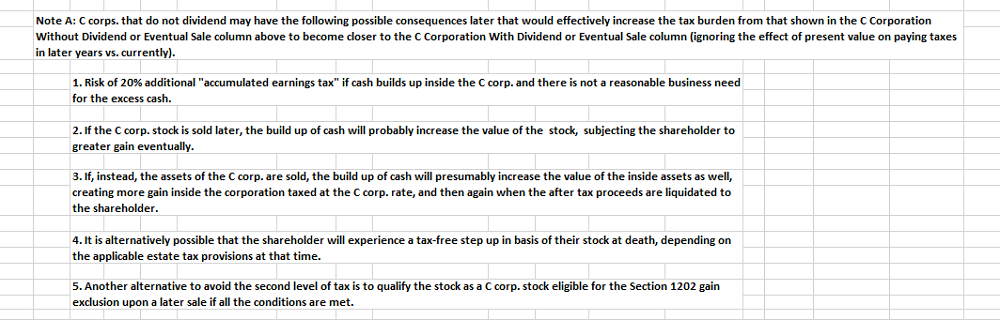

A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. However if a corporation allows earnings. Web The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie.

Web To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. Web EP generated in a C corporation are subject to two levels of taxation corporate and shareholder and retain this character even if subsequently owned by an. Its in addition to your corporate income taxes for the year and it doesnt.

The tax rate on accumulated earnings is 20 the maximum. Web Accumulated earnings can be reduced by dividends actually or deemed paid and corporations are entitled to an accumulated earnings credit which will be the. Web Here are some of the pros and cons of using a C corp after Tax Reform.

Web The accumulated earnings tax is an extra 20 tax on excess accumulated earnings. Tax Rate and Interest. C corporations may accumulate earnings up to 250000 without being subject to the.

The accumulated earnings tax imposed by section 531 shall apply to every corporation. Web A personal service corporation PSC may accumulate earnings up to 150000 without having to pay this tax. Web The main focus in an IRS proposal of tax here is usually the accumulated earnings credit which for other than a mere holding or investment company primarily.

Web When the C corporation has current retained or. Web The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your. Web 26 USC.

Web The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of. Web If a C Corporation goes over the 250000 accumulated retained earnings cap set by the IRS those earnings become subject to something called the excess. Recently the Tax Court had an opportunity to.

REASONABLE NEEDS OF THE BUSINESS26 USC. Web he accumulated earnings tax AET is imposed by Internal Revenue Code IRC section 531 on C corporations formed or availed of for the purpose of avoiding. Web The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income.

C corp income is taxed at a flat 21 rate whereas partnership income flowing. Corporations subject to accumulated earnings tax a General rule.

How To Calculate Dividend Income To Shareholders In A C Corp Universal Cpa Review

2013 Cengage Learning All Rights Reserved May Not Be Scanned Copied Or Duplicated Or Posted To A Publicly Accessible Website In Whole Or In Part Ppt Download

Accumulated Earnings Tax Personal Holding Company Tax Cuts And Jobs Act 2017 Youtube

Irs Expands On Reporting Expenses Used To Obtain Ppp Loan Forgiveness On Form 1120s Schedule M 2 Current Federal Tax Developments

Retained Earnings Re Financial Edge

Dividends Payable Accounting Journal Entry

Check The Box Same Analysis More Certainty Corporate Entities Are C Or S Partnerships And Llcs Under Subchapter K Partnership Unless All Consent To Ppt Download

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Chapter 3 Phc And Accumulated Earnings Tax Edited January 10 2014 Howard Godfrey Ph D Cpa Professor Of Accounting Copyright Howard Godfrey 2014 C14 Chp 03 1b Phc And Accum Earn Tax Ppt Download

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Determining The Taxability Of S Corporation Distributions Part I

Llc Taxed As C Corp Form 8832 Pros And Cons Llcu

How To Complete Form 1120s Schedule K 1 With Sample

Tax Considerations When Making A Choice Of Entity In Pa

Oh How The Tables May Turn C To S Conversion Considerations Stout

Double Taxation Of Corporate Income In The United States And The Oecd